Week Ending June 27, 2025

BEEF

The market is steady to firmer. Total beef production for last week was down 1.0% versus the prior week and down 7.4% compared to the same week last year. Year to date, total production is down 3.2% compared to the same period last year. The total headcount for last week was 554,000, as compared to 616,000 for the same week last year. Year to date, the total headcount is 14.01 million head, which is down 6.4% from last year. Live weights for last week were down 4 lbs. versus the prior week and are up 41 lbs. from the same week last year. Trading on live cattle continues to be choppy and moved lower in mid-week sessions. Depending on the day, live futures can show some strength, followed by some profit taking due to overbought signals. Beef production just posted the lowest volume year-to-date for a non-holiday week. Year to date slaughter is down 5% but production pounds are only down about 1.2% which is a result of higher cattle weights. As the supply side implements 4-day work weeks and reduced hours, production is tight with many shortages being reported. Recent tariff news keeps the industry in an unsettled situation. Retail and distributive buyers are being conservative before making large future commitments in case the market shifts. Beef demand remains strong as the retail channel has started to pull volume for their July 4th features. Carcass cutout values continue to inch higher due to limited supply. With the high costs of beef, the spread between choice and select grades remains tight. The overall carcass cutout value has been on the rise and trade values on a category-by-category basis have strong undertones.

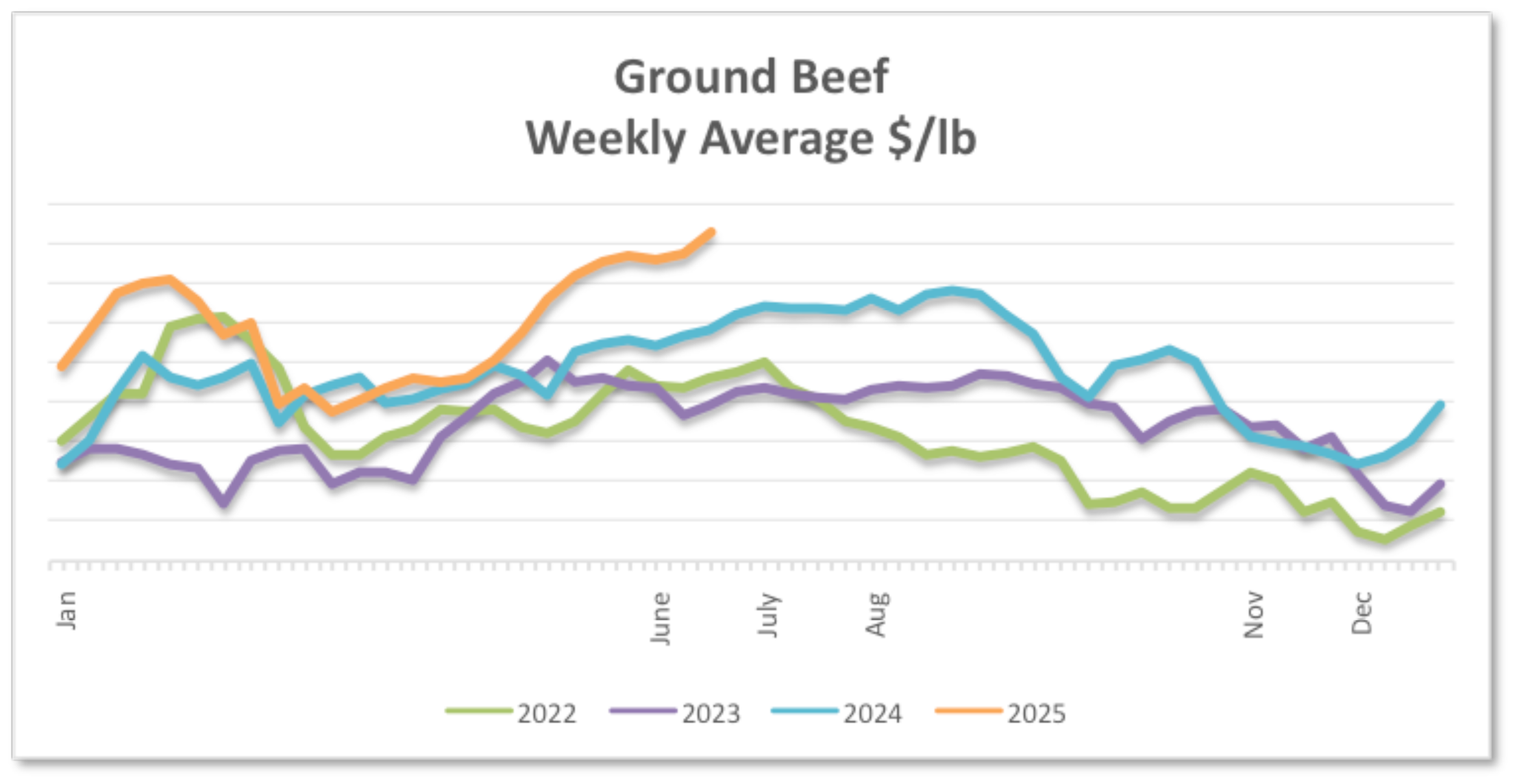

Grinds – The market is steady to firmer. Seasonal demand is vibrant, and July 4th business is driving additional volume. The supply side is tight and imported trim from Australia and Brazil is needed to fill the void. Trade levels on 73% and 81% grinds are firm, and spot loads are getting a premium.

Loins – The market is steady to weaker. Retail and food service volume is seasonally strong. Holiday features are adding to the demand momentum. Supply is tight and varies by packer. Market levels receded over the last week from a 52-week high.

Rounds – The market is steady to firmer. Volume for XT insides in the month of May was 39% higher than the 4-week moving average. With grinding operations using more rounds due to lack of trim, demand is robust. Availability varies by packer and producing plant. Market values are inching higher.

Chucks – The market is steady to firmer. Retail business continues to be the main driver. With the category getting additional business from grinding operations, supply is being squeezed. Supply varies by packer and sourcing facility. Trade levels have been rising slightly.

Ribs – The market is firmer. With retail orders shipping to support the July 4th Holiday, seasonal demand is hitting a high point. Supply is limited. Market levels have risen over the last week.

PORK

The market is steady to firmer. Total pork production for last week was down 0.5% versus the prior week and down 1.1% compared to the same week last year. The total headcount for last week was 2,365,000 compared to 2,412,000 for the same week last year. Live weights for last week were even compared to the prior week and up 3 lbs. versus the same week last year. Summer demand is meeting and exceeding expectations across the industry. With July 4th features on the horizon, retailers have begun their holiday shipments over the last week. Tariffs continue to have industry participants concerned but limited information is being reported about any actual effects. At the current time, approximately 25% of U.S. production goes to the export channel. Lean hog futures dipped in midweek trading but recovered quickly. Current futures have unsettled overtones as many contracts are approaching overbought territory. Trading values on loins, butts, and ribs have strong undertones as the industry enters the July 4th Holiday week.

Bellies – The market is steady to firmer. Demand from the retail and food service channels is strong. Trading activity has picked up and supply has tightened on fresh and frozen raw material. Frozen stocks are reported to be at the lowest level in about two years. Trade levels have been pressured higher.

Hams – The market is firmer. Demand for bone-in hams continues to be strong and market levels are up 15% year-over-year. Boneless hams are getting a seasonal bump from the retail deli channel. Supply is available. Market levels continue to show strength.

Loins – The market is steady to firmer. Overall demand for bone-in loins is strong with July 4th retail features on the calendar. Boneless demand is status quo both domestically and abroad. Supply is available. The market on bone-in has been moving high while the market on boneless loins is flat.

Butts – The market is steady to firmer. Domestic demand is hitting peak seasonality and holiday features are adding to the momentum. Export demand with Mexico and the Pacific Rim is moderate. Supply has tightened over the last 30 days. Trade levels moved higher over the last week

Ribs – The market is steady to firmer. As expected, current demand is strong with holiday features and summer smokehouse business kicking in. Freezer supplies for the summer grilling season are reported to be adequate. Supply varies by packer and plant. The markets on spareribs, St. Louis Ribs, and back ribs are trading at the higher end of the range.

CHICKEN

The market is mixed. The total headcount for the week ending 6/21/2025 was 169,025,000 as compared to 166,652,000 for the same week last year. The average weight for last week was 6.50 lbs. as compared to 6.58 lbs. for the same week last year. Demand is well supported with July 4th Holiday features. With supply on the rise, there appears to be corrections with some categories showing strength and some declining quickly. After the market showed strength early in the year, trading partners are now taking a cautious approach. Spot trading on boneless breast meat continues to be weak, and the category is showing excess supply on the larger sizes. Conversely, spot loads of tenderloins and wings continue to catch a premium. Export demand for leg quarters and whole legs is reported to be status quo at the current time. Slaughter numbers have picked up recently and that is starting to affect trading values in multiple categories. Hatchability has finally risen above 2024 levels but is still below the 5-year average. Demand is seasonally strong, but spot trading is testing both ends of the trading ranges.

WOGS – The market is unsettled. Retail deli and QSR business is moderate to good with holiday features in place. Supply is tight on premium and cutting stock WOGS. Market levels are static while customers are wondering what the market will do after the holiday.

Tenders – The market is steady. Strong demand from the fast-food channel continues to be the main driver of the category. In addition, custom portioning remains strong. Supply is limited. The market on select and jumbo sizes has flattened out.

Boneless Breast – The market is weaker. Retail and food service demand is adequate, but the market is starting to show signs of weakness and a potential correction. Custom portioning has slowed down and product in combo bins is getting limited demand. Excess supply is hitting the open market on the larger sizes. The market on jumbo and medium boneless has been moving lower on a daily basis.

Leg Quarters and Thighs – The market is steady. Domestic demand for drums and thighs has picked up in combination with grilling season. Export business on whole legs is a full steady. Supply is tight on drums and boneless thigh meat. Market levels on the back half of the bird are moving sideways.

Wings – The market is steady to firmer. Demand from the foodservice channel has picked up in recent weeks. Further processors are starting to replenish inventories. Supply has tightened over the last month. The market has been pressured higher on jumbo and medium wings.

TURKEY

The market is steady to firmer. The total headcount for the week ending 6/21/2025 was 3,980,000 as compared to 3,712,000 for the same week last year. The average weight for last week was 31.99 lbs. as compared to 32.98 lbs. for the same week last year. Domestic and export demand is moderate to good and not showing any signs of slowing down. Whole birds, back-half parts, and boneless breasts continue to be highly sought after with limited supply being shown. Due to the respiratory virus reported earlier this year, bird weights are lower than expected and the overall supply is being squeezed. Slaughter data shows the number of turkeys processed year to date is down 10% from last year. With recent news of plant closures, additional supply is not on the horizon anytime soon. Due to limited supply, asking prices are on the rise for boneless breast, drums, and wings. Market levels across all categories continue to have strong undertones.

Whole Birds – The market is steady to firmer. Demand is limited with very few spot transactions being reported. Product availability is hard to find. Most suppliers are communicating that they are sold out until further notice. Market levels on spot loads have been reaching a premium.

Breast Meat – The market is steady to firmer. Seasonal demand from the retail deli and QSR channels is fully engaged. Fresh and frozen supply is scarce on the spot market. Market levels continue to inch higher

Wings – The market is steady to firmer. Export business on whole wings is fair. Domestic volume on two-joint wings is adequate. Supply is tight due to limited slaughter statistics. The market is being pressured higher on Tom-sized wings.

Drums and Thigh Meat – The market is steady to firmer. Export demand for drums is moderate to good. Demand for thigh meat is well supported by retail, food service, and further processing. Supply is tight on parts and thigh meat. The market on drums and thigh meat has strong undertones.

SEAFOOD

White Shrimp – The market is weaker. Supplies are adequate to fully adequate with moderate demand.

Black Tiger Shrimp – The market is firmer. Demand is moderate to good and pricing levels are firmer. Availability is tight on the premium sizes.

Gulf Shrimp – The market is steady to firmer. Supplies are barely adequate to adequate while maintaining a firm undertone.

North American Lobster Tails – The market is mixed. The current market for small to mid-size tails and meat products remained stable, likely supported by renewed demand. In contrast, larger tails face ongoing challenges, with additional discounts reflecting continued buyer preference for smaller sizes.

Salmon – The market is unsettled. Farmed salmon is unsettled with pricing influenced by sellers’ supply positions. There are reports of offers above and below the current range. The West Coast whole fish market is firmer. Supplies are adequate with moderate demand. There are reports of offers above the range. Europe is reporting a weaker market. Recent landings are currently outpacing demand. The Chilean whole fish market is weaker. Supplies are adequate to fully adequate with quiet to fair demand.

Cod – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Flounder – The market is steady and mostly unchanged.

Haddock – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Pollock – The market is firmer. Supplies are adequate with moderate demand.

Tilapia – The market is unsettled. There are reports of slow demand, which has the potential to create long inventory positions.

Swai – The market is steady to firmer.

DAIRY

CHEESE

The market is mixed. The CME Block & Barrel market were mixed as the week progressed. Both markets trended weaker than the prior week. Milk outputs across the nation are mixed. In the East, many cheese makers report taking in additional loads of milk. In the Northeast, several cheesemakers report slower production in several locations. In the Central region milk outputs vary. Higher temperatures in the southern portion of the region are contributing to decreased outputs. Cheese production in the region is generally strong. Some cheesemakers in the region report that unplanned downtime recently has contributed to milk being available for processing. In the West, cheese makers report milk volumes are meeting production needs. Production in the region is steady. Varietal cheese loads for spot buys are mixed. Demand for cheese in the retail and food service sectors is steady. Inventory is reported to be healthy. Domestic demand is moderate to steady. Export demand varies from steady to stronger. According to the USDA’s latest report, domestically produced cheese is priced competitively to the international market. International demand for cheese is steady.

European milk production is declining week-over-week. Year-over-year milk production is mixed. Sources in the industry note that milk outputs from Germany and France are down while the United Kingdom and Ireland’s outputs are up. European cheese makers note milk intakes are sufficient for cheese production. Current outputs are in balance with demand. Demand for foreign type cheeses is strong from both the retail and food service sector. Outdoor dining along with food service sales are below seasonal expectations. Demand from southern European regions is steady. Export demand is mixed.

BUTTER

The market is mixed. The butter market was mixed as the week progressed and trended weaker than the prior week. Cream availability varies from steady to lighter across the nation. In the Northeast, butter churns are reported to be operating seven days a week. In the Central region, cream outputs are declining. Warmer temperatures are negatively affecting cow comfort and thus decreasing milk outputs. According to the USDA, contacts in the Central region report that fat content is up from a year ago, thus allowing plenty of cream available in region. In the West, butter production varies from steady to stronger. Butter makers are actively churning across the country to build up stock butter for later in the year. Retail demand for butter is strong. According to the USDA’s most recent report, the CME prices for butter are trending up. Demand for bulk butter is steady. Domestic demand is steady. Domestic butter prices are competitive against butter produced outside of the United States. Demand from international buyers is strong.

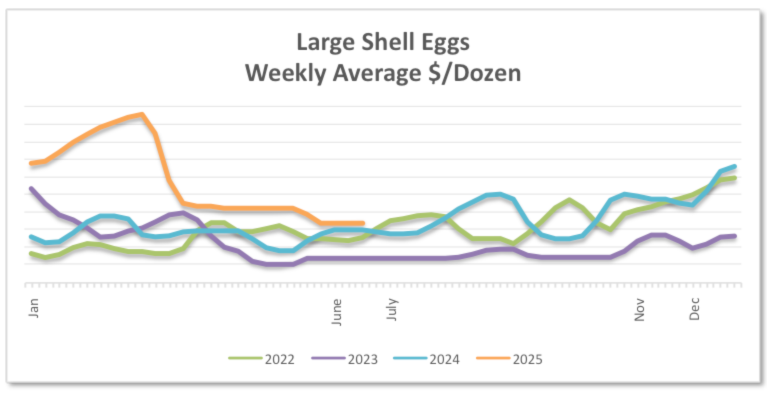

EGGS

The market is steady to weaker. Retail demand is moderate with some July 4th features helping drive short-term sales. Lower shelf prices and targeted promotions are helping with consumer engagement at several major retailers. However, rising temperatures nationwide have reduced interest in baking and heat-intensive cooking. Summer routines are influencing the foodservice sector, with distributors in travel-heavy areas seeing modest gains driven by increased foot traffic. However, the end of the school year has softened institutional demand.

Market levels are moving lower on medium and large sizes. National weekly reports show shell egg inventory up 8.5% and breaking stock inventory up 4.5% over last week.

Demand in the egg products category is starting to slow down. Liquid whites are being sourced below quoted levels on the open market. Liquid yolks have been steady since the month of May but are now showing some weakness in the spot market. In the dried market, demand for yolks and whites is soft and the market has weak undertones.

FLUID MILK

The market is mostly steady. The summer heat has begun affecting milk production in many regions, though some regions are not seeing many changes. In the Northeast, milk production is holding steady. Despite the rising temperatures, there have not been noticeable drops in volume. In the Southeast, milk production is slightly lower but is keeping up with production demands. Contacts in the region note that milk components are decreasing seasonally but are higher than they were in previous years. In the Central region, increasing temperatures are contributing to reduced cow comfort, according to the USDA. Contacts in the Midwest note milk outputs are steady though production in some areas is declining. In the Southwest, milk output has decreased due to high temperatures. Approximately 14% of the dairy cows nationally are in an area experiencing drought. In California, milk production has trended downward throughout the month. Cooler nighttime temperatures in many areas of the state have assisted in mitigating the production decreases. Some handlers note June 2025 year-over-year milk outputs are up. In the Pacific Northwest, farm level milk outputs are ticking down. Class I demand is light in the Western region as some of the final educational institutions break for the summer. Manufacturers in the region note milk volumes are in line with processing capacities. Class I, III, and IV demands are steady. Across the nation, Class I milk for bottling is seasonally slower but moving at a steady pace. Fluid milk is being diverted from bottling plants to other manufacturing processes. Class II production is strong. Ice Cream and frozen dairy mix production is in full swing. Class III milk availability is strong, though some cheese manufacturers are slowing production. Some cheesemakers noted unplanned downtime over the past week. That said, many cheese manufacturers are running busy production schedules to utilize the milk available to them. Class IV production is strong. Cream is readily available across most of the nation. Demand for cream is steady to strong. Ice cream manufacturers and butter makers are pulling on available supplies. Spot loads of cream are available.

OIL

Soy Oil – The soybean oil market is mixed. Soybean oil markets were down early in the week with modest gains later. Increasing tensions in the Middle East also contributed to the sharp rally in soybean oil as prices followed the energy complex higher. Petroleum crude oil and diesel futures staged impressive rallies when news of the Middle Eastern conflict began. At one point, petroleum crude oil was up, although prices backed off the highs and were trading up slightly. The market will be watching developments in the Middle East extremely closely in the coming weeks as ongoing conflict could severely impact crude oil flows out of the region.

Canola Oil – The Canola seed market is mixed. The firming tone in canola seed futures continued for a second consecutive week as the July contract hit an 18-month high and closed the week up nearly 3%. A long speculative position combined with slow farmer selling and dry conditions in Western Canada have helped underpin the market. Last week the EPA released guidance on the upcoming biofuel mandate that was interpreted as a significant increase over the current year. This sent an initial jolt into the canola complex, but the strength faded slightly as the included language in the guidance is aimed at limiting imported biofuel feedstocks which would likely include Canadian canola oil.

Palm Oil – Palm oil futures are mixed and saw an upward momentum towards the end of the week bolstered by a surge in petroleum crude and diesel futures due to unrest in the region. India has been strengthening their import share as they as the need to rebuild local stocks to a manageable level. Argentina has lowered export taxes through June, with the plan of creating additional competition in destination markets.

Olive Oil – The Extra Virgin Olive Oil market has had a strong rebound in all Mediterranean olive oil-producing countries including Portugal, Spain, Greece, Morocco, and Tunisia. Spain, the market leader for Extra Virgin Olive Oil, accounts for 45% of global production. They are expected to produce approximately 1.4 million tons of olive oil this year, their largest production since the 2021 season.

COCOA

The cocoa market is unsettled. Supply issues for cocoa have been exacerbated by long lasting structural problems within the industry. Price increases on cocoa and any products produced with cocoa should be expected throughout the year.

COCONUT

The coconut market is unsettled. Cost increases have continued beyond expectations and are now at record highs. This is due to climate conditions, soaring demand and reduced production capacity. Climate patterns from El Niño and La Niña have impacted growing and harvesting conditions. Surging demands from other countries, notably China, has contributed to deficiencies in the market. According to the United Coconut Association of the Philippines, there have been government initiatives in conjunction with the Philippine Coconut Authority to address rising demand and costs in the market. Price increases on coconuts and any products produced using coconuts should be expected throughout the year.

COFFEE

The coffee market is unsettled. Coffee prices are expected to continue soaring due to adverse weather in both Brazil and Vietnam. Drought and higher temperatures in Brazil during the fruit development and filling period caused Arabica and Robusta yields to fall below initial projections. Price increases on coffee should be expected to continue throughout 2025.

IMPORTED PINEAPPLE

Indonesia – Total raw material volume for 2025 is expected to align with 2024 at approximately 590K MT. The harvest is weighted towards the second half of the year, with only 40% of total volume available in the first six months. Supplies will be tighter early in the year, especially for choice-grade products.

Thailand – The 2024 harvest was one of the lowest in decades, totaling 692K MT, a 4% decline from 2023. Production in 2025 is forecasted to improve to 850K MT, but this remains below the six-year average of 930K MT. Due to ongoing supply constraints, market conditions are expected to remain firm.

Overall Market Outlook – From Indonesia, raw material volumes are forecast to remain lower through Q3 2025. While Thailand’s production is forecast to increase, the overall market remains constrained. Pricing is anticipated to stay firm, with potential fluctuations depending on demand and crop performance.

PASTA

With general economic and policy uncertainty impacting most industries, pasta is not immune to market fluctuations. Wheat values remain stable to slightly declining, as markets anticipate a new crop. Dried egg products are continuing to experience unprecedented market highs due to the continuing avian influenza crisis. For packaging, the paperboard market has continued to rise since the start of the year, with moderate increases announced by producers for the second half. Labor and transportation markets will also continue to be a factor as the year progresses.

SUGAR

Domestic Cane Sugar – The market is mixed. According to the June World Agricultural Supply and Demand Estimates report, Cane sugar production is projected at 9.254 million STRV, a 30.889 STRV decrease in production from last month. Projections are based on modest acreage growth in Louisiana and stable acreage in Florida.

Domestic Beet Sugar – June WASDE indicates production at 5.150 million STRV is reduced 29,750 from last month on a small decrease in projected sugar beet yield.

Mexico’s sugar projections are the same as last month at 5.094 MT. Production has yet to recover fully from the effects of severe drought from two seasons ago.

WHEAT

The wheat market is mixed. Winter wheat harvest in the US is 19% complete. The outlook for US wheat in the upcoming year is for slightly larger supplies, unchanged domestic use, higher exports, and lower ending stocks. Soft Red Winter and White Winter production is offset by lower Hard Red Winter wheat production. According to the June World Agricultural Supply and Demand Estimates report, this month’s global wheat outlook is for reduced supplies, higher consumption, higher trade, and lower ending stocks. Supplies are projected to be down on reduced beginning stocks for Russia which is offsetting higher production from the EU and India. Global consumption has been raised mainly on higher food, seed and industrial use in Nigeria, Sudan, and India. Annual projected global stocks have been lowered on reductions for Russia, the United States, Iraq, and Turkey.

**Graphs represent data for the week ending June 20, 2025**